Sep 7, 2022

For companies looking to streamline processes and increase productivity, accounts payable is a common focus area. Paper invoices and human error have historically plagued accounts payable, making automation a great solution.

According to Ardent's State of ePayables 2021 research study, today's AP leaders are at an inflection point when it comes to automating AP. Nearly 60 percent of businesses currently use eInvoicing solutions, and within the next two years, 65 percent of businesses state that they will have automated the complete procure-to-pay cycle.

Despite this, many companies are still hesitant to automate their accounts payable departments. Maybe you've heard that automation is too expensive, or that your company is too large or too small to benefit from automation, or that automating means losing direct financial control. Or maybe you've heard horror stories about botched automation implementations that have made you wary of switching.

These myths about accounts payable automation are just that: myths. And falling for them is holding your company back from being as time-effective and cost-efficient as possible. While it’s true that AP automation requires an initial investment and time commitment, automation has tremendous long term benefits and ROI.

Our experts at Milner are here to bust three common myths about accounts payable automation so you can automate your systems and simplify your AP process.

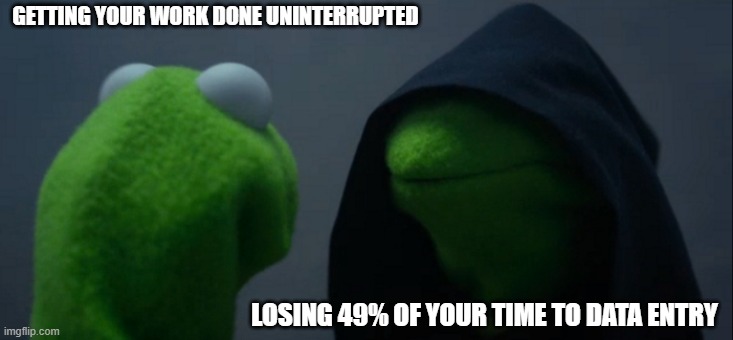

It is common for finance teams to believe that their current processes are efficient, but research has proven otherwise. Your AP department's current process is not as efficient as it could be if it remains manually managed. Research indicates that finance leaders spend 49% of their time processing transactions. Taking this into consideration, your team spends around ten days each month processing and paying vendors. Despite a 15 percent reduction in average invoice processing costs over the past year, invoices still cost on average $9.25 to process, with the average cost to process a single supplier payment at around $8.64.

With AP automation through Milner, vouchers, payments and invoices are automatically matched and filed electronically, eliminating data entry errors. You can make the most of your AP electronic workflow through our intelligent capture software which automates document categorization and unstructured information extraction from e-mail, MFPs, file imports and traditional scanners. Employees can even use their mobile devices to capture information and transmit it into content management or begin a workflow task remotely.

The introduction of new technology may cause your company to fear that retraining employees and working collaboratively with all departments will be difficult. Or they might be afraid that the system will be down and you won’t be able to process invoices and payments while an automated system is being implemented.

.png)

However, data entry, retrieval, and filing into ERP systems are not the best ways to leverage your accounting and finance talent. Then there are interdepartmental file requests, additional copies, and obscure reports that can complicate matters further. By capturing invoice information electronically at the beginning of the process, key strategic questions around time management can be answered.

Additionally, invoice exceptions continue to consume a large amount of time and resources in 2022, increasing costs and time for invoice processing. In the past year, 5 percent of all invoices have been flagged as exceptions, requiring AP staff to take additional action, wasting company time and money. The automation of non-value added tasks can relieve your staff of these burdens. With automated exception-based management, you can free up your staff to focus on your higher-value strategic priorities. The benefit of saving time and reducing errors will also be evident to your staff, so they'll be happy to participate.

Though you may be concerned about losing control of your process, you shouldn't be. By automating the process, authorized users have access to all invoice statuses at any time, providing them with greater visibility. Employees are held accountable for their roles in the approval process, and invoices are no longer left unattended. As invoices move through workflows, processes are automatically updated, allowing for more time to deal with exceptions.

AP has become remarkably more complex over the past few years as the workforce has changed dramatically. Research shows that 46 percent of employees in an average organization are non-employees, contingent employees, or extended employees. Invoices, 1099 forms, reporting requirements, inquiries, payment flexibility, and other considerations have increased AP's workload as a result of the massive shift in talent acquisition over the past decade. It is expected that 59 percent of enterprises will leverage ePayables technology in 2022 to support the management of these agile workforces. Could your company benefit from this extra automated support?

.png?sfvrsn=a3fc7db5_2)

Other technologies that offer more control over AP processes include the straight-through, or "touchless" process. Through this automation, an invoice is received, approved, and the payment is scheduled without the accounts payable team's involvement. This type of workflow process is significantly faster and cheaper than any other invoice approval workflow process and results in enormous operational and financial efficiencies. Your business could be an industry leader in providing quick and seamless AP processes in 2022 by joining the 30.5 percent of companies to process invoices using this "touchless" state.

Automating is the best way for your company to achieve top results and stay competitive. Additionally, automation will enable you to scale your accounts payable department quickly and cost-effectively without having to hire more staff.

We are an industry leader in accounts payable workflow automation.

With Milner's automated accounts payable workflow, you'll gain visibility, control, and efficiency at every stage of your accounts payable process with intelligent invoice data capture, workflow automation, and seamless ERP integration. Reach out to schedule a demo or to get your questions answered by a document management expert at Milner.