As an organization receiving checks for Receivables, you understand the volume of time typically spent opening the mail, manually posting the payments in your accounting system, preparing the deposit, and then finally getting to the bank. Once this is complete, you need to store the documents per your internal retention policy.

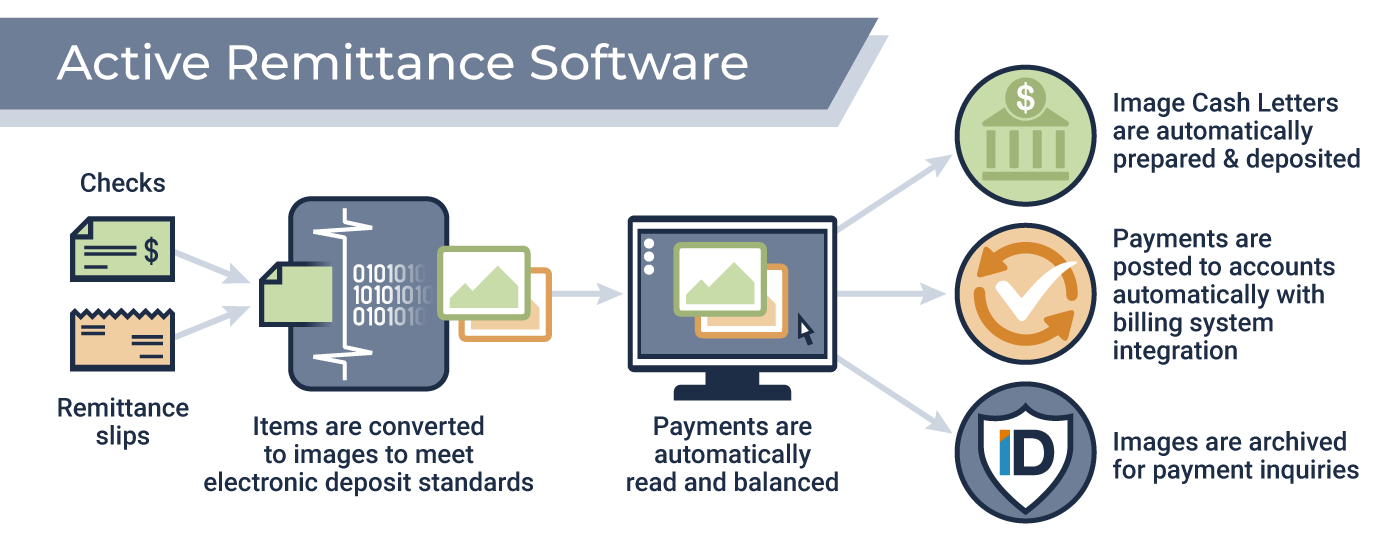

Active Remittance automates payment processing through these steps, including electronically depositing funds to your bank of choice. Our process will allow you to split the deposit across banks, if needed. It will also store your check and stub documents in an archive for proper retention and retrieval.

Eliminate most manual entry. Active remittance will improve data efficiency, reducing the manual data entry required for exceptions. You can process payments with or without a billing remittance, look up open invoices, and batch post to your accounting software.

Automated bank deposit preparation. The Image Deposit module will prepare and transmit your deposits to the institution of your choice, allowing for split deposits across multiple accounts. This module can be deployed separately for an additional layer of security.

Improve productivity. Our customers report automating check processing has improved their A/R productivity by as much as 70% due to the streamlined process of posting and depositing checks.

Document retention. Our document retention component securely stores the encrypted images. You can configure the archive to follow your retention policies and allowing you to destroy the physical document quickly, reducing the security risk of onsite storage.

Accounting Firm

Raleigh, NC